Part 1 of this series discussed how to find your sample ballot, and information on ballot structure and Inspectors. It can be viewed here.

This part is a discussion about the Constitutional Amendment, appearing on the back side of the ballot, that all Pennsylvanians have the opportunity to vote on. It reads:

This part is a discussion about the Constitutional Amendment, appearing on the back side of the ballot, that all Pennsylvanians have the opportunity to vote on. It reads:

Proposed Constitutional Amendment Amending the Homestead Property Tax Assessment Exclusion.

“Shall the Pennsylvania Constitution be amended to permit the General Assembly to enact legislation authorizing local taxing authorities to exclude from taxation up to 100 percent of the assessed value of each homestead property within a local taxing jurisdiction, rather than limit the exclusion to one-half of the median assessed value of all homestead property, which is the existing law?”

Wow. Very confusing and hard to understand. And it was purposely written that way.

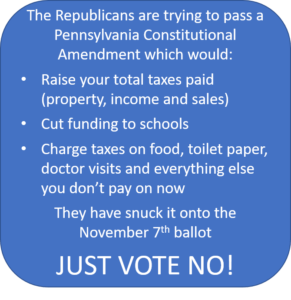

The simple answer is JUST VOTE NO!

Below is the rationale for that answer. Apologies if your eyes glaze over.

Anything that changes taxes in the state must either raise new taxes, as the increase in the gas tax last year did, or it must be revenue neutral. That means that if this amendment is enacted, the legislature will increase other taxes to keep the income stream equal to what it was before the change. What they’re not telling you in the paragraph on the ballot is what their plans are for increasing other revenue flows.

First, the plan is to increase sales taxes in the state. In addition to a percentage increase from 6% to 7%, the plan is to include as taxable many goods and services that are not currently taxed. A brief, albeit incomplete, list:

- Food (including what you buy at the Farmer’s market, putting a new bookkeeping burden on small farms)

- Toilet paper and other personal care items

- Clothing

- Medication

- Textbooks (sold at school book stores are currently excluded)

- Heating fuel

- Doctor visits

- Hospital costs

- Service providers: accountants, lawyers, landscapers, snow removal, contractors, etc.

In terms of what this means to you, ask yourself what you spend on food to eat at home every week. $50? $100? More? Now add 7% to that. If you spend $100/week (and that’s low statistically), you’re looking at an additional $364/year.

Let’s talk going to the doctor. Let’s say that you have an appointment and the amount charged to the insurance company is $150. You may only pay $4.00 if you’re on Medicaid, $10 on Medicare, or maybe $20 on private insurance. You now will owe 7% of the full $150, due at the time of the appointment and not billable to insurance.

That medication you pay a few dollars for? You will owe taxes on the full amount, and again, point of sale, not billable to insurance.

And that’s just sales tax. There will also be an increase to your income taxes. Currently, the rate is 3.07%. Pretty small, especially compared to other states. You can figure that it will come close to doubling. (Remember “revenue neutral”.) The Pennsylvania Constitution has always codified that income taxes must be regressive, meaning that the same percentage applies to those at the lowest and highest income levels.

Finally, this does not preclude the addition of other revenue streams to increase state coffers (remember, these taxes are statewide and not local). These could include increases to Earned Income Taxes, use taxes, and other state-mandated fees.

Let’s talk about the connection. Right now, schools are funded (with the exception of Philadelphia, which is a situation unto itself) primarily by an allotment from the state for basic education, with additional funding made up for by property taxes. If this amendment passes, individual cities and towns will be in a position to do away with property taxes. There is no obligation on the part of the state to make up those funds. Thus, the monies for “non-basic” education, which includes things like enrichment programs, special needs programs, etc. may go unfunded, to the detriment of students. Obviously, property taxes, which could fill the gap, may not be available.

There are a few other points that may not be obvious. First, people who live in rental units may think that they don’t pay property taxes, and thus feel unaffected. However, their landlords DO pay property taxes, and it’s built into the rental fee. If you think that your rent will go down if the landlords no longer need to pay property taxes, you’re sadly mistaken: it just changes to profit for the landlord.

The next point is that if you itemize your Federal taxes, Real Estate taxes are deductible as a line item. There is an additional line item for Income OR Sales taxes. Thus, if you are now paying additional Income and Sales taxes, you can only deduct one, and you lose the amount generally paid for Real Estate taxes, therefore increasing the amount you will pay in Federal taxes.

The morality question related to this proposal is that they less money one makes, the more he/she is affected. Take a child’s asthma inhaler. Let’s say the billing price is $134 (which is about average) for an inhaler. Right now, the parents may pay, say $4 for sCHIP or Medicaid. With the new taxes, they would owe an additional $9.38, or more than double. That’s not a big deal if you make $70,000 a year, but it’s a real problem at minimum wage. Further, the increased cost of food brings up the question about whether SNAP funds will cover the taxes, thus decreasing the amount available for actual food, or will those taxes need to be paid with cash?

The biggest question, however, is WHY would the Republican legislature want to do this? There are a few reasons. First, there does need to be some modification to property tax structure, but saying “NO, we won’t charge anyone” isn’t the way. Especially since these taxes are assessed locally and there are great differences between municipalities. Second, the Republicans believe that cutting services is not a problem: they don’t care if people die on the streets due to malnutrition or physical ailments. Third, they believe in home schooling and charter schools and other things that undercut public education. Again, the rich are fine, and everyone else suffers.

So JUST VOTE NO!

Leave any questions in the comments. And remember to vote on 7 November – let’s REALLY drain the swamp.